5 Reasons Why Investors Trade Bonds

Contents:

Simply log into Settings & costs to establish a swiss bank account and select «Cancel» on the right-hand side. Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for 65 € per month. I wanted to know whether there are any free paper trading platforms available online.

The intent of this communication is not recommendatory in nature. Bondholders with convertible securities can convert their securities into equity stocks of the company. After conversion, you can avail all the benefits of being an equity shareholder of a firm. You can either keep your securities till maturity or convert them into shares. All in all, the bond market is large and diverse, and the CFD market offers an exciting pathway to the potentially lucrative opportunity it presents.

- The yield curve is a graphical representation of the relationship between interest rates and bond yields of different maturity periods.

- So, the asset is mortgaged till the principal amount is repaid.

- Conversely, if the bond goes up in price to $1,200, the yield shrinks to 8.33% ($100/$1,200).

- Essentially, you are lending a part of the overall loan the government is seeking.

- The increased price will bring the bond’s total yield down to 4% for new investors because they will have to pay an amount above par value to purchase the bond.

In these types of bonds, principal amount and interest payments are indexed to inflation. These are issued by the government and are one of the safest types of bonds to invest in. These investment bonds are issued at a discount, but redeemed at the principal amount. Some bonds, known as zero-coupon bonds, offer a return once they’ve matured.

There are a few easy to understand variables that you need to look at before deciding on an investment in these two G-Sec instruments. The loan which the government intends to repay within a year is called the Treasury Bills or T-bills. Loans which the Government intends to repay over many years are called the Bonds. The level of portfolio diversification that they add, as well as the liquidity to get in and out of a holding according to the individual investor’s plan—are big pros of bond ETFs.

How Do I Buy Bonds?

Because of this, callable bonds are not as valuable as bonds that aren’t callable with the same maturity, credit rating, and coupon rate. A popular strategy to consider when trading government bond futures is the Five Against Bonds Spread . If you don’t want to speculate, you can take the safer route and buy units in mutual funds that invest in bonds. You can invest in both government and corporate securities through this method. However, you will have to pay the cost of owning a mutual fund, reducing the overall return.

While not as risky as stocks on average, bond prices do fluctuate and can go down. If interest rates rise, for example, the price of even a highly rated bond will decrease. The sensitivity of a bond’s price to interest rate changes is known as its duration. A bond will also lose significant value if its issuer defaults or goes bankrupt, meaning it can no longer repay in full the initial investment nor the interest owed. Investors can purchase these bonds from a broker, who acts as an intermediary between the buying and selling parties. These secondary market issues may be packaged in the form of pension funds, mutual funds, and life insurance policies—among many other product structures.

This depends on your investment goals, timelines and desired risk-to-return ratios. Bonds are traditionally looked to as a means by which to diversify a stock portfolio and earn a fixed income. They can lessen an equity portfolio’s exposure to market risk as a sudden stock market downturn may not see a depreciation in bond prices.

Credit-Upgrade Trade

If prevailing interest rates increase, prices for existing bonds are likely to fall because the coupon it offers is less valuable compared to new bonds. Buying individual bonds via your brokerage account is more complicated. Typically online brokers offer access to bond secondary markets, which means that availability and prices wholly depend on existing holders looking to sell.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. While both the investment options have their pros and cons, for a retail investor PPF remains to be a popular choice for retirement than tax bonds.

Municipal Bonds

Because sovereign debt is backed by a government that can tax its citizens or print money to cover the payments, these are considered the least risky type of bonds, in general. Liquidity risk is when you are unable to sell your bond in the secondary market without a loss in value. Bonds like Power Grid Corporation of India Ltd pay high coupon rates but these bonds haven’t been traded in the last six-seven years. So, exiting such bonds is difficult for retail investors due to low liquidity. Bonds because of their lower volatility and relative safety compared with stocks.

Owning individual bonds lets you lock in a specific yield for a set period of time. This approach offers stability, as the yields offered by bond funds can fluctuate over time. There are multiple ways to own bonds, with different strategies tailored to the needs of every kind of investor.

Hence, a bond will always cost more than the quoted price in the secondary market. Let us now move ahead and understand the effect of price fluctuations and how to invest in bonds through the secondary market. Another popular type of bond in India is Sovereign Gold Bond . They are issued by the central government of India for those who wish to invest in gold. The bond pays fixed 2.5% annual interest and comes with a maturity period of eight years.

Central Government Bonds

Bonds are essentially a fixed-income loan to a government or corporate entity. Other factors include compliance with relevant regulations, international presence, and various services offered. In India, the market for bond brokers is untapped, with only a few significant players. All you need to do is visit the IIFL website or download the IIFL Markets app to get started. An investor may not necessarily hold a bond for its entire tenure.

The term to maturity or age of a bond has a significant impact on a bond price. At maturity, the issuer is expected to pay the bondholder the full principal amount. Thus, bond prices will tend to move closer to the Par Value as the maturity date draws near. The term to maturity also determines how a bond reacts to interest rates. By issuing corporate bonds, companies can raise capital at a low cost.

In India, these bonds are issued by theReserve Bank of India on behalf of the central government. A bond is a form of debt or a loan which is given by the public to corporations or the government. In exchange, the borrower or bond issuer agrees to pay a fixed rate of interest and return the borrowed capital on maturity. It has competitive pricing with a $1 bond transaction fee on secondary bond trades through its online platform. The company provides more than 40,000 offerings, some of which are commission-free.

The Bloomberg Government/Corporate Bond Index, also known as the ‘Agg’, is an important market-weightedbenchmark index. Like other benchmark indexes, it provides investors with a standard against which they can evaluate the performance of a fund or security. As the name implies, this index includes both government and corporate bonds.

FIVE at FIVE AU: Interest turns to next week’s rate decision as … – Proactive Investors Australia

FIVE at FIVE AU: Interest turns to next week’s rate decision as ….

Posted: Thu, 27 Apr 2023 05:50:00 GMT [source]

Against this loan, we promise to pay the bank periodic interest and also return the money after a certain amount of time. This is common practice, where the interest and principal are repaid to the bank. You are investing in Bonds/T-bills issued by the Government of India.

I-bonds falling to 4.3% sounds bad, but with a 0.9% fixed rate, you might actually want to trade up

The https://1investing.in/ promises to pay the investor interest over the term of the bond , and then return the principal back to the investor when the bond matures. Bond ETFs are exchange traded funds that invest in fixed income securities. They can be passively or actively managed, and the fees are typically lower than bond mutual funds.

TradFi Banks Team Up to Create Digital Bonds Trading Platform on Blockchain – CoinDesk

TradFi Banks Team Up to Create Digital Bonds Trading Platform on Blockchain.

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

Bonds represent debt financing, while stocks equity financing. Bonds are a form of credit whereby the borrower (i.e. bond issuer) must repay the bond owner’s principal plus additional interest along the way. Stocks do not entitle the shareholder to any return of capital, nor must they pay interest .

Shares in troubled U.S. lender First Republic Bank hitting a new record low this week and a looming showdown over the U.S. debt ceiling suggest volatility will continue. Bonds can be volatile, acknowledged LGIM’s Jeffery, citing sharp, fast moves in Italian, UK and emerging market debt within the last decade. Bonds can be bought through a broker, an ETF or directly from the U.S. government.

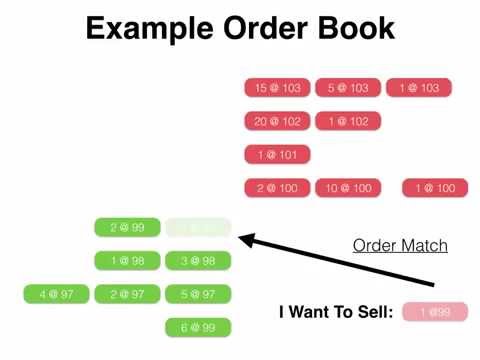

A puttable bond usually trades at a higher value than a bond without a put option but with the same credit rating, maturity, and coupon rate because it is more valuable to the bondholders. When interest rates drop, bonds become more desirable, and their prices rise. If you believe this will be the case, you’d adopt a ‘long’ position on your chosen government bond futures market. When going long, you elect to ‘buy’ a derivative to open your trade. As bonds are ‘negotiable securities’, they can be bought and sold in the secondary market.

A bond’s price changes on a daily basis, just like that of any other publicly traded security, where supply and demand at any given moment determine that observed price. Bonds are commonly referred to as fixed-income securities and are one of the main asset classes that individual investors are usually familiar with, along with stocks and cash equivalents. Inflation is an increase in the aggregate price level as measured by changes to a price index, like the CPI. When inflation is high, the dividends paid by shares and the fixed coupons paid by bonds both lose value in real terms – ie they have lower purchasing power.

Companies issue corporate bonds to raise money for a sundry of reasons, such as financing current operations, expanding product lines, or opening up new manufacturing facilities. Later, in the middle ages, governments began issuing sovereign debts in order to fund wars. In fact, the Bank of England, the world’s oldest central bank still in existence, was established to raise money to rebuild the British navy in the 17th century through the issuance of bonds. The PPF interest rate touched its peak @ 12% in 2000 thereafter in the last two decades it has been hovering around 8%.

Buying bonds (premium vs discount) – Jamaica Observer

Buying bonds (premium vs discount).

Posted: Sun, 09 Apr 2023 07:00:00 GMT [source]

Thus, you see that both Tax-free bonds and PPF are complementary and totally different products. While investing for retirement, you need to choose between them depending on the benefits and which is best suited to your needs. PPF is used more as an accumulation tool and bonds (Tax-free or otherwise) are looked at for investment for a regular income. As regards Tax-free bonds are concerned, you cannot reinvest once the bonds mature.